Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

The Credit Card Competition Act (CCCA) is a proposed federal law that would change the way most credit card transactions are processed in the U.S. Currently, almost all transactions can be processed on only one card network.

Visa card transactions are processed only via the Visa network; Mastercard card transactions are processed only via the Mastercard network; American Express cards are processed only via the American Express network, and Discover card transactions are processed only via the Discover network.

These exclusive arrangements exist because Visa and Mastercard, the two largest networks, prohibit their issuers from offering multiple-network cards, and American Express and Discover issue their single-network cards directly to consumers.

In this guide, I will cover everything you need to know about the CCCA, its goals, and how it would impact consumers.

-

Navigate This Article:

Objectives of the Credit Card Competition Act

According to the bill’s sponsor, Sen. Richard Durbin (D-Ill.), the CCCA’s primary aim is to enhance competition and choice in the credit card network market. Durbin and other supporters of the proposal say more choice and more competition would result in lower costs for merchants and lower prices for consumers.

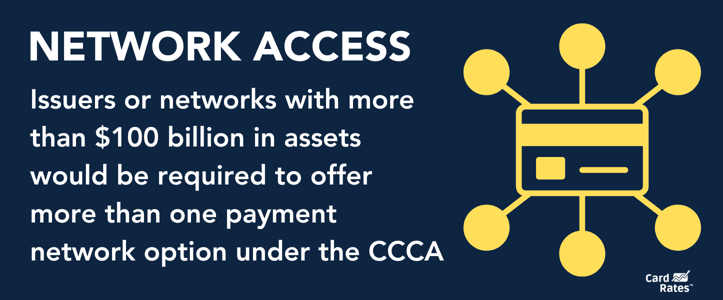

If the CCCA becomes law, exclusive single-network arrangements will be prohibited for card issuers with more than $100 billion in assets. Instead, the cards they issue will have to allow a choice of at least two networks to process transactions with that card.

Only 32 banks and one credit union in the U.S. currently have more than $100 billion in assets. The list includes Chase, Bank of America, Wells Fargo, and Citi, among others. These and other large banks issue most of the cards in use.

Top 10 Banks by Managed Assets:

| 1. JPMorgan Chase | $3.5 trillion |

| 2. Bank of America | $2.6 trillion |

| 3. Wells Fargo | $1.7 trillion |

| 4. Citibank | $1.7 trillion |

| 5. U.S. Bank | $669.4 billion |

| 6. PNC | $562 billion |

| 7. Goldman Sachs | $549.2 billion |

| 8. Truist Bank | $526.7 billion |

| 9. Capital One | $478.9 billion |

| 10. TD Bank | $369.9 billion |

Currently, the choices of which networks will be used for specific transactions are made by consumers when they decide which cards to present to merchants to pay for purchases. If the CCCA were enacted, consumers would still have a choice of which cards to present when they make a purchase, but the merchant, rather than the consumer, would choose which of the networks associated with that card would process that transaction.

Historical Context

Credit cards weren’t subject to much government regulation until about 60 years ago. Since then, multiple federal laws have been enacted to ban practices that lawmakers believed could prove harmful to consumers and increase transparency by requiring new disclosures.

Existing federal laws that regulate cards currently include the Truth in Lending Act (TILA), Fair Credit Reporting Act, Equal Credit Opportunity Act, Fair Credit Billing Act, Credit Card Accountability, Responsibility and Disclosure (CARD) Act, and Dodd-Frank Wall Street Reform and Consumer Protection Act.

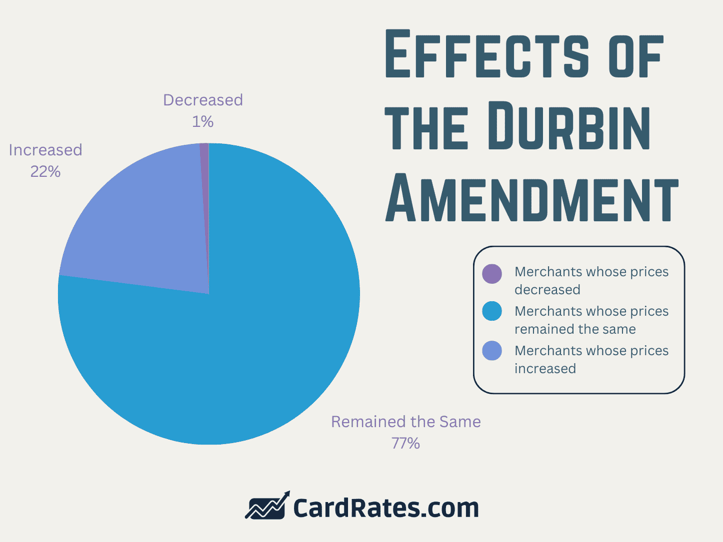

The Durbin Amendment, introduced by the same senator who introduced the CCCA, authorized the Fed to cap certain fees banks can charge for debit card transactions, was enacted as part of Dodd-Frank.

The full impact of that law still isn’t clear today, though a 2015 report from the Federal Reserve Bank of Richmond found that post-Durbin 77% of merchants didn’t change their prices, 22% raised their prices, and only about 1% reduced their prices.

The so-called Schumer Box, which requires additional disclosures on card statements, was added as an amendment to the TILA.

Though the CCCA is widely known as the Credit Card Competition Act of 2023, it was initially introduced in 2022. After failing to pass in 2022 or 2023, it was reintroduced in 2024. If enacted, it would amend yet another federal law: the Electronic Fund Transfer Act.

Impact on Issuers

Card issuers don’t just issue cards. They also coordinate the approval process for each transaction, check to see whether the transaction involves card fraud, transfer funds to merchants, and collect payments from consumers. The approval, security, and funds transfer may seem to happen instantaneously when a card is swiped, but they can, in fact, take a few days to complete.

The CCCA wouldn’t alter these basic functions but could impact card issuers in other ways. Increased competition among card networks might put downward pressure on card-processing fees, which are split among issuers, processors, and networks.

Issuers might also face added costs if card processing companies passed along their costs to reprogram or replace card processing machines that weren’t designed to give merchants a choice of networks. Some devices may already have this capability or be easy to switch over.

Consumer Benefits

Consumers don’t normally see the fees that issuers are charged when a card is used to make a purchase. That’s because consumers don’t pay these fees directly. Instead, a small amount is deducted from each transaction.

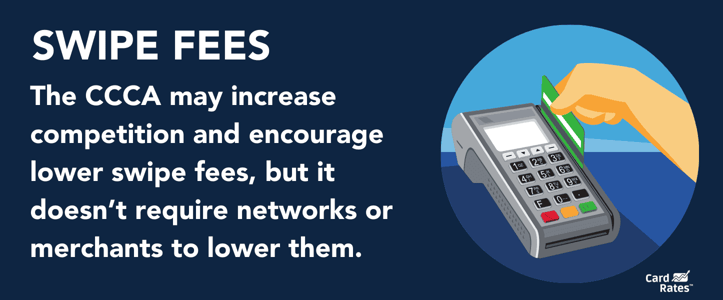

These amounts, known as swipe fees, are shared by the card issuer, payment processor, card network, and merchant’s bank. The funds that remain after the swipe fee is deducted are paid to the merchant for the consumer’s purchase.

Merchants say card swipe fees are too high, while card companies say they are fair. Consumers have no say in these fees.

Supporters say the CCCA would increase competition in the card processing market, resulting in lower swipe fees, which merchants would pass along to their customers in the form of lower prices. If that occurred, consumers would benefit.

The catch is that the CCCA doesn’t actually require lower swipe fees. In fact, one industry group suggested a possible scenario in which card issuers would add second networks that were more expensive to preserve their preference for a network their customers liked.

That could result in higher swipe fees, which merchants might pass along to their customers in the form of higher prices.

Card companies also point to other potential harms to consumers. These include the loss of the ability to select which network they want used to process their transactions, and fewer choices of cards, card networks, and card rewards programs.

A group of airlines that offer mileage rewards programs have declared their opposition to the CCCA, even though they’d presumably benefit from lower card swipe fees. In a joint letter, the group said the proposal would put their rewards programs at risk by failing to address the costs, risks, and unintended consequences of the legislation.

Key Provisions of the Credit Card Competition Act

The Credit Card Competition Act, S. 1838, directs the Federal Reserve to create specific regulations to implement the proposal’s intents and purposes.

Here’s a summary of what these regulations would do:

Limit Single-Network Cards

A card issuer or payment network with more than $100 billion in assets would not be allowed to restrict the number of payment networks on which a card transaction could be processed to only one network. It also could not restrict it to only two or more networks if those networks are owned, controlled, operated by, or affiliated with the issuer.

If the card issuer was required to allow more than one network and only two networks were allowed, those two networks could not be the two largest in the U.S. based on how many cards they’d issued. Currently, the two largest networks on this basis are Visa and Mastercard.

Together, these requirements would mean that if multiple networks were required, but only two were offered, only one could be Visa or Mastercard while the other would have to be either American Express, Discover, or one of the other much smaller networks. If the Federal Reserve later determined that Visa, Mastercard, or both were no longer the two largest networks, this requirement would be eliminated.

If a smaller payment network was also the card issuer, the issuer wouldn’t have to provide a choice of more than one network. Currently, this provision would exempt American Express and Discover from the requirement to provide a choice of networks.

Merchant Choice of Card Network

Rather than allowing consumers to choose a network by choosing a card for payment, the CCCA would allow the merchant to choose which network to process the payment on. Card issuers, processors, and networks wouldn’t be allowed to penalize merchants for choosing any particular network over another.

The CCCA would also require the Fed to create a public list of card payment networks that were deemed to pose a national security risk to the U.S. or were owned, operated, or sponsored by a foreign government.

Effects on Merchants and Small Businesses

Today, merchants can choose whether to accept cards — in addition to cash and paper checks — as a form of payment from their customers. If they decide to accept cards, merchants can also pick which types of cards they want to accept. Each card type has a different fee structure, so some may be more appealing to merchants than others.

Cost Reductions and Savings

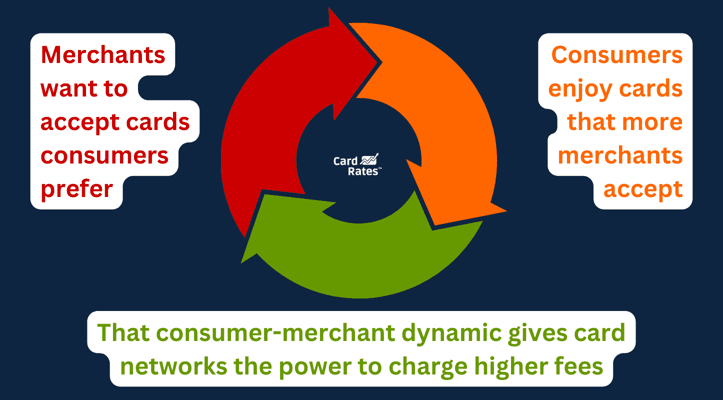

A report by the Congressional Research Service (CRS) concluded that merchants preferred to accept cards that more consumers liked. It also found that consumers tend to like cards that more merchants accepted and this circularity gave card networks more market power to charge higher processing fees.

If giving merchants the ability to choose among card networks disrupted this circularity and resulted in lower fees, merchants and small businesses would benefit. This may explain why merchants and small businesses generally like the CCCA, judging by statements their trade groups have issued.

The CRS report also concluded that the ultimate impact of the CCCA wasn’t certain, in part because the circularity might not be disrupted. Small businesses may not even be aware of the alternative card networks that offer lower prices.

More Competitive Pricing

If the CCCA resulted in lower card swipe fees for merchants, they could use their savings to offer their customers lower prices or take other steps to increase customer satisfaction or loyalty. Merchants could also use their savings for other purposes, such as expanding their operations, paying off debt, or improving profitability.

Merchants have already won two limited victories in court.

In 2019, an appeals court upheld a $5.6 billion settlement in a lengthy class-action lawsuit in which retailers challenged swipe fees charged by Visa and Mastercard and industry practices related to those fees.

Separately, Visa, Mastercard, and a number of banks that issue their cards agreed to settle an antitrust case in which a group of merchants challenged their swipe fees and related practices. If it is upheld, the settlement could lower swipe fees by 0.04% for three years and require Visa and Mastercard to continue to offer merchants the same swipe fee rates that were in effect on December 31, 2023, for an additional five years.

Neither of these settlements would require card issuers, networks, or merchants to refund swipe fees to consumers. Nor would they require merchants to lower the prices consumers pay for purchases.

The Credit Card Competition Act Benefits Consumers and Businesses

Lower prices would be a welcome boon for consumers, particularly during a prolonged period of higher inflation rates. But there’s no guarantee that, if enacted, the CCCA would produce those promised price savings.

Will the CCCA — if it’s enacted — produce more consumer-friendly results? Consumers will have to have to wait and see.

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![How to Calculate APR on a Credit Card ([updated_month_year]) How to Calculate APR on a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/CalculateAPR-1--1.png?width=158&height=120&fit=crop)

![Hardship Accommodations By Credit Card Issuer in [current_year] Hardship Accommodations By Credit Card Issuer in [current_year]](https://www.cardrates.com/images/uploads/2021/08/Hardship-Accommodations-By-Credit-Card-Issuer.jpg?width=158&height=120&fit=crop)