Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

Your credit utilization ratio (CUR) represents how much of your total credit limit you are using. CUR typically applies to credit cards and certain revolving lines of credit.

Your CUR can also show potential lenders how responsible you are with your finances and is a significant factor in credit score calculations.

-

Navigate This Article:

How to Calculate Your Credit Utilization Ratio

When you want to figure out your credit utilization ratio, you should first identify how much of your credit limit you are using. This is a simple but important aspect of your finances to be aware of because it can affect your credit scores.

Know Your Total Credit Limits and How Much You Owe

Lenders and card issuers determine the maximum amount you can spend for any given account. To do so, they look at information about your financial history. First, they usually check your credit reports and scores, which show how well you’ve managed borrowing money in the past. They also may review your income, debt, and housing costs.

You need to know the limit on each credit card you own and the total across all accounts to calculate your CUR. You can include revolving lines of credit, but not ones secured by assets such as your house or car.

The Basic Formula

You can use a simple formula to calculate the credit utilization ratio for your credit cards: Divide the total amount you owe on your cards by the total credit limit of all your cards. Then, multiply the result by 100 to get your CUR percentage. You can use the same formula to calculate each card’s CUR separately.

Here’s the formula for calculating your credit utilization ratio written as an equation:

Credit Utilization ratio = (Total Amount Owed / Total Credit Limit) ×100

For example, if you have a credit card with a limit of $100 and you spend $50, your credit utilization ratio is:

CUR = ($50 / $100) ×100 = 50%

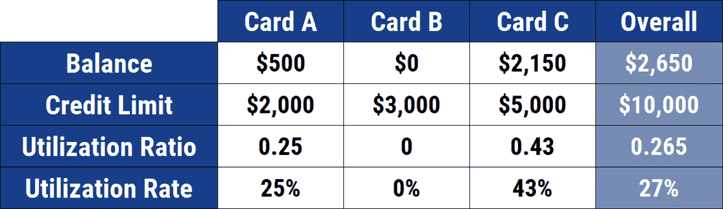

The following chart illustrates the CUR for a person who owns three credit cards:

It’s untrue that paying off your credit cards in full every month means your utilization ratio is 0%. What really counts is the balance on your credit reports at a certain time each month (usually the statement closing date), not whether you pay it off by the due date. So, even when you pay in full, your utilization ratio may not be 0% if your report shows a balance.

Calculation Tools and Resources

Apps and online calculators can make it easy to identify and track your credit utilization. These tools can automatically calculate your ratio using the balances and credit limits from your credit accounts.

Some apps even help you monitor your credit score and keep track of your credit utilization ratio. They connect to your credit accounts and update your ratio each time your balance or credit limit changes.

Many websites offer free calculators. You can enter your total credit limits and the amounts you owe, and the calculator does the math, returning your credit utilization ratio in percentage form.

These tools can allow you to stay aware of your credit utilization and help you manage your credit scores — which include CUR is an important aspect.

How Credit Utilization Impacts Your Credit Scores

Your credit utilization ratio is a significant factor in determining your credit score because it shows how much you rely on credit. Responsibly managing your CUR can help you maintain a good credit rating.

Your CUR Significantly Impacts Your Credit Rating

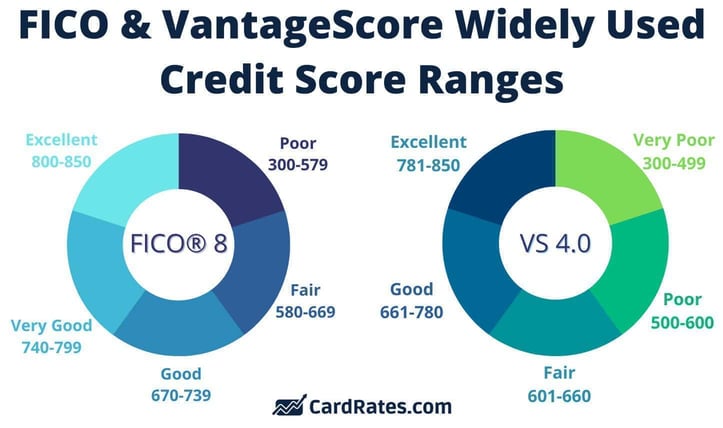

A credit score is a number that represents how likely you are to repay borrowed money. The three big credit bureaus — Experian, Equifax, and TransUnion — use information from lenders, credit card companies, and other sources to calculate credit scores. They receive updates about your loans, credit card use, and other financial details every month.

Each bureau calculates your credit score differently, but they all consider factors such as your payment history, how much you owe, and how long you’ve had credit. The two main scoring models they use are FICO and VantageScore.

FICO is the leading credit scoring model for consumers. It assigns 30% of your score to the amount you owe, which includes your credit utilization ratio, i.e., your credit card balances compared to how much credit you have available. Note that CUR is just one part of this factor and not the full 30% of your credit score.

In 2006, the big three credit bureaus joined forces to create VantageScore, a new credit scoring model to compete with FICO. While creditors widely use VantageScore, it’s less popular than FICO. VantageScore considers your balances on installment loans but focuses more on your revolving credit.

VantageScore assigns a full 20% of your score to your credit utilization. In addition, it assigns 6% of your score to your total debt.

Ideal Credit Utilization Ratios

It’s generally a good idea to keep your CUR under 30%. A higher ratio may indicate you need to use more income to repay your balances in full.

According to FICO, the lower your CUR, the better that is for your score. But it also states that if your ratio is 0%, that doesn’t give FICO much information about how you use and manage credit.

VantageScore wants to see your CUR no higher than 30%, which shows you have carried balances under control. Reducing your CUR can quickly strengthen your credit score.

Examples of Impact on Credit Score

The following examples give you a better idea of how CUR can help or hurt your credit score. Note that two or more events might occur at the same time.

- From High to Low Utilization: Suppose you have a $1,000 total credit limit across your three credit cards, and you usually carry a balance of $800. Your overall CUR is 80%. This high ratio can hurt your credit score because it shows you rely too much on credit. Your CUR drops to 20% if you pay down your balance to $200. Doing so can also improve your credit score because it shows less use of your available credit.

- Maxing Out Credit Cards: Your CUR for a credit card is 100% if it has a $500 limit and you spend all $500. Maxing out your cards can indicate financial stress.

- Paying Off a Card Completely: If you pay off one of your cards completely, your overall CUR will go down. For example, suppose you repay one card and reduce your total credit balance from $1,000 to $700 while your total limit remains $2,000. In that case, your overall CUR goes from 50% to 35%, which helps your credit profile.

- Increasing Your Credit Limit: Suppose you have a credit balance of $500 and a limit of $1,000 (i.e., your CUR is 50%). Your CUR drops to 25% if your credit card company increases your limit to $2,000 without you spending more. Lowering your utilization in this way can improve your credit score.

These examples show how reducing your CUR can help boost your credit scores.

How Credit Utilization Affects Lending Decisions

Credit utilization is a crucial factor that lenders consider when you apply for a loan. It helps them determine how responsibly you use credit.

A Key Indicator of Creditworthiness

When you apply for a loan, lenders check your credit utilization ratio to see how well you manage your credit. A high ratio may scare lenders into thinking you rely too much on credit. That’s a red flag in the industry.

On the other hand, a low ratio shows that you could use more of your available credit, but choose not to. Lenders may feel that shows discipline and that you manage your finances well. This, in turn, makes you look like a safer bet for lending money.

A Lower Ratio Can Mean a Lower Interest Rate

A lower credit utilization ratio can help you obtain lower interest rates on loans. Lenders may see you as a low-risk borrower if you consistently maintain a low credit utilization. Accordingly, they may offer you loans at lower interest rates.

What a Low CUR Can Communicate About You to Lenders:

- You don’t rely too heavily on credit.

- You manage your finances responsibly.

- You’re capable of repaying a loan.

- You deserve loans with lower interest rates.

They do this because they’re more confident that you’ll pay back the loan without a hassle. Lower interest rates make your loans cheaper.

Strategies to Manage Your Credit Utilization

Managing your CUR is key to maintaining a good credit score. Here are some strategies for keeping your CUR low.

Requesting Credit Limit Increases

The easiest way to ask for a credit limit increase is to contact your credit card company’s customer service department via app or over the phone. Some have an automated process that returns a decision quickly, and you don’t have to speak with anyone.

If you do call a representative, let them know you want to increase your credit limit. The representative will review your account details and use the company’s system to determine whether you qualify for a higher limit.

To improve your chances of getting the increase, call when your credit is in good shape. Make sure you have been making payments on time for at least six months, and try to reduce any existing credit card debt as much as you can before you request a higher limit.

Higher income and/or lower expenses will also help your cause. When you apply for more credit, consider sending additional information about your financial situation.

You can include evidence of a higher salary, a new job, or proof that you’ve paid off a significant debt, such as a car loan. These factors can make you look like a lower credit risk.

Therefore, if you speak with the representative, ask if you can send this information before they decide to increase your credit limit. This can help them see the full picture of your financial health.

Spending Across Multiple Lines of Credit

Using several credit accounts can help you manage your credit utilization. You can spread your purchases across multiple cards instead of maxing out one card, helping keep the balance on any single card lower relative to its credit limit.

Just remember, the key is to keep the total spending across all cards manageable and not to increase overall debt. Credit models look at individual and aggregate CURs when calculating credit scores.

Consolidation and Balance Transfers

Consolidating your debts with loans or balance transfer offers can be helpful if you have high balances on several high-interest-rate cards.

Before you start borrowing to consolidate your debts, you need to figure out how big your loan should be and what interest rate you’ll need. A personal loan must be big enough to cover all of the credit card debts you want to consolidate and should have an interest rate that’s lower than the APRs you are currently paying.

Remember to include any loan fees in your calculations. Origination fees are common and are usually 1% to 5% of the total loan amount. Lenders generally deduct this fee from your loan before you receive the funds.

For example, suppose you owe $12,319 on your credit cards, and the lowest APR you have is 17.99%. You’ll need a loan for at least $12,935. This amount includes your debt plus 5% for the origination fee, and the APR should be less than 17.99%.

Once you know how much you need, you can start looking for a lender. Compare a few options to find the best offer. You can arrange for the lender to send the money directly to the credit card issuers to repay your balances. Alternatively, you can accept the loan proceeds in a bank account and repay each of the credit cards yourself.

Another beneficial feature of loan-based consolidation is that installment loans do not count in your CUR. With a consolidation loan, you can reduce your credit card CUR to 0% and get an immediate credit score boost, even though you may still owe the same amount of money.

It’s wise to stick your credit cards in a drawer until you pay off the consolidation loan. You can use a debit card to shop and make bill payments during the payoff period. You also need to ensure you make your loan payments on time.

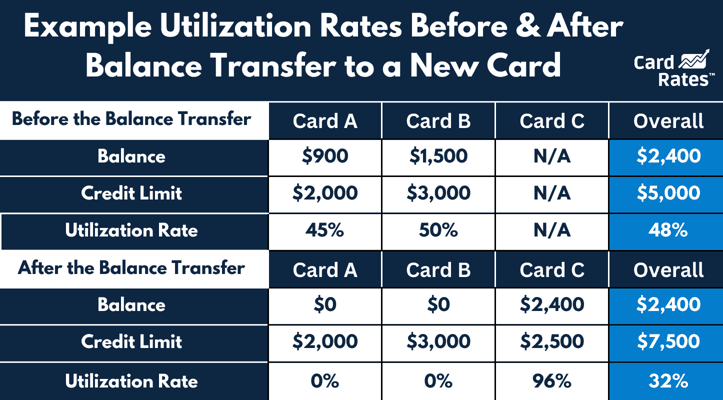

Another way to consolidate credit card debt is through balance transfers. You’ll need to do some basic math to figure out how much credit card debt you want to transfer. This will help you know the credit limit you need if you decide to use a balance transfer credit card.

You can typically transfer debts from multiple cards to one balance transfer card. The total cannot exceed the card’s limit, and this includes any balance transfer fees.

For example, if you wish to transfer $2,000 in balances and the card charges a 5% balance transfer fee, you’ll need a credit limit of at least $2,100 to complete the transfers.

The process of consolidating your debt with a balance transfer depends on whether you’re using an existing card or applying for a new one. You can request the transfer when you apply for a new card or initiate it through your online banking platform for existing cards.

Remember, you generally cannot transfer balances between cards from the same issuer.

Balance transfers usually take seven to ten days, but some can take longer. Make sure to pay at least the minimum amounts if your other credit card bills are due before the transfer is complete. This can help you avoid late payments that damage your credit score.

Also, keep in mind that an introductory 0% APR promotion on balance transfers will eventually expire, and your APR will return to the normal rate. Any remaining balance then starts accruing interest at the regular rate.

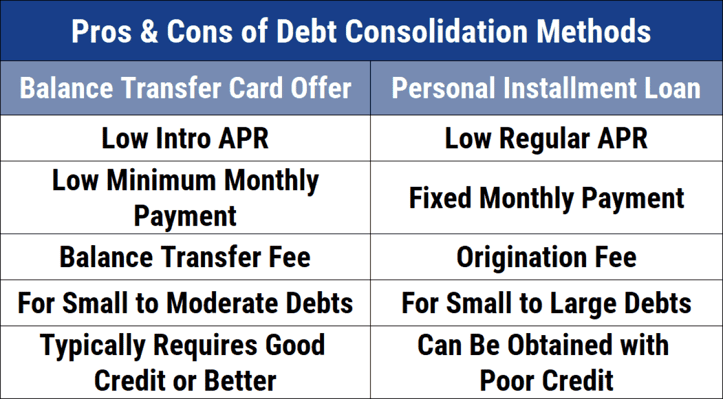

The following chart summarizes the differences between the two consolidation methods:

| CRITERIA | PERSONAL LOAN | BALANCE TRANSFERS |

|---|---|---|

| Interest Rates | Generally lower | Often low or 0% initially |

| Fees | Origination fees | Balance transfer fees |

| Impact on Credit Score | Quick effect on your score | Initial positive impact that can improve over time |

| Flexibility in Use | Broad usage for debts | Primarily for credit card debt |

Balance transfer promotions are a great way to reduce your CUR gradually as you repay the transferred amount. A personal loan is preferable if you want a faster credit score boost and fixed monthly payments.

Long-Term Benefits of a Healthy CUR

Maintaining a healthy credit utilization ratio provides several long-term benefits that can help improve your finances. Keep your CUR low for an extended time period to help boost a low credit score and qualify for more beneficial financing options.

Better Rates and Terms

You show lenders that you are responsible if you consistently maintain a low CUR. This behavior can lead to better loan and credit terms in the future. Lenders may offer you lower interest rates, which can save you a lot of money over time.

They may also offer you more favorable repayment terms, such as longer repayment periods or more flexible loan conditions. All of these benefits can make borrowing cheaper.

Keeping a low CUR can also help you get credit cards with more favorable rates, features, and terms. When you use less of your available credit, it shows credit card companies that you can manage credit responsibly.

Benefits of Optimizing Your Credit Utilization Ratio

- Lenders may offer you lower interest rates.

- You can access more flexible loan conditions, including longer repayment periods.

- Lenders may offer you cards with more rewards and benefits.

Issuers may offer you credit cards with lower interest rates, which means you’ll pay less money on any balances you carry. They may also offer you cards with better terms, higher rewards, more benefits, or lower fees.

Increased Borrowing Capacity

Keeping a good CUR could mean more borrowing power. When lenders see that you use a small portion of your available credit, they are more likely to trust that you can manage more credit.

This can lead to higher credit limits on your existing credit cards or approval for larger loans. An increased borrowing capacity may also give you more financial flexibility, which you’ll appreciate if you suddenly need money for an emergency.

Credit Score Improvement

Since your CUR accounts for a substantial part of your credit score calculation, keeping it low typically leads to higher scores. A higher credit score opens up many doors, including making it easier to qualify for mortgages, auto loans, and other types of credit.

It may also be beneficial in non-lending situations, such as renting an apartment, finding a job, or paying lower security deposits on utilities.

By managing your CUR effectively, you position yourself for an improved credit score. In turn, that can lead to greater financial success, access to better borrowing options, and more improvement in your overall credit health.

Your Credit Utilization Ratio Can Signal Financial Responsibility

The credit utilization ratio is a key indicator of financial responsibility. By maintaining a low CUR, you can boost your credit score and enhance your attractiveness to lenders. This can lead to better credit offers, lower interest rates, and more favorable terms on loans and credit cards.

Ultimately, a good command of your CUR can provide great advantages for your finances and a better lifestyle.

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)