Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

An annual fee is a charge you pay once a year to use a credit card. It’s like a membership fee for having the card. Some credit cards have this fee, whereas others do not. The annual fee may be a fixed number, but some cards, especially those for bad credit, may alter the fee after the first year.

Typically, the higher the fee, the more rewarding the card. Unless it’s from a subprime issuer, in which case, it’s one of the many fees people with poor credit must face to gain access to unsecured credit. We’ll dive into why issuers charge annual fees, the types of cards that charge this fee, and how to determine whether it’s worth paying — the answer’s not the same for everyone.

-

Navigate This Article:

Why Issuers Charge Annual Fees

Issuers typically charge annual fees to offset large rewards programs or to reduce risk when working with bad-credit borrowers.

Some credit cards offer many rewards, such as points or cash back, and travel benefits. These can be very valuable, and the annual fee helps the credit card company cover the cost of these rewards.

In addition, some credit card applicants do not have a good credit history – they’ve had trouble paying back money in the past. Issuers see these customers as risky. The annual fee helps reduce the risk for issuers by providing them with some money upfront, just in case the cardholder has trouble with payments later on.

High annual fees send a signal to consumers that a card is especially valuable and aimed at those wealthy enough to afford it. It’s not exactly snob appeal, but it does create an exclusive aura around the card that the well-heeled may find appealing.

Common Types of Cards With Annual Fees

Credit cards with annual fees are quite common and have varying perks and costs. Their yearly fees can range from a few dollars to thousands.

Several categories of credit cards have an annual fee, which varies depending on the type of card. Generally, cards with more benefits and high credit limits have larger fees.

People choose these cards based on what benefits they offer and how much they’re willing to pay each year. It makes sense to choose a card that closely matches your needs and spending habits. For example, those who want to save on everyday purchases could choose a lucrative cash back card, whereas frequent fliers would likely benefit most from a travel card offering points or miles.

Premium Cards

Premium credit cards are a specific type of card with high annual fees, but they also offer luxurious benefits. They attract consumers who can use these perks to the fullest.

The benefits of these cards often include exclusive access to airport lounges, higher rates of reward points on purchases like travel and dining, complimentary hotel upgrades, and travel insurance. Two examples are the The Platinum Card® and Chase Sapphire Reserve®, which are popular among affluent consumers.

Premium cards charge annual fees of several hundred dollars or more. Still, they return significant benefits if you use them to their fullest extent. For some, the value of credits, large reward rates, and high credit limits can far exceed the annual fee.

Anyone considering a premium card should carefully evaluate whether the benefits justify the fee. Please compare the actual value of the perks against the cost of the annual fee to ensure it makes financial sense to own the card. Base your decision on your personal or business travel and spending patterns.

Alternatively, suppose you are ultra-wealthy and demand the best of everything. In that case, you may want to own exclusive cards with exceptionally high credit limits, such as the Centurion Card from American Express (a.k.a. the “Black Card”) or the J.P. Morgan Reserve Card.

Sure, these super-premium cards have high annual fees, but that’s the easiest hurdle for their intended audience. The cards expect owners to meet extravagant income and spending targets and are available by invitation only.

Travel and Rewards Cards

Travel and rewards cards give you points, miles, or cash back when you spend money using the card. The idea is simple: The more you purchase, the more rewards you earn.

You can use your rewards for various goodies, including plane tickets, hotel stays, or cash back to reduce your credit card bill. Rewards cards are great if you pay your entire balance each month, as you get all the benefits without paying interest.

Travel and cash back cards with annual fees often offer more generous rewards. The Chase Sapphire Preferred® Card and the Capital One Venture X Rewards Credit Card are popular choices.

Both of these cards charge an annual fee. Still, in return, they offer significant rewards for travel-related expenses and everyday purchases. These cards are especially useful for people who travel frequently or who use their credit cards for most of their daily spending.

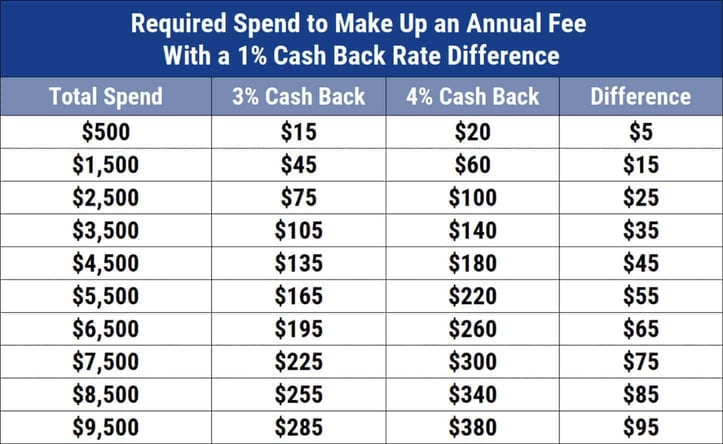

Typically, the more you pay in annual fees, the better the rewards. For example, high-fee cards usually have more points per dollar spent, better signup bonuses, and more valuable perks, such as free travel insurance or no foreign transaction fees.

It’s important to compare the fees you pay to the rewards you receive. The high rewards can justify the higher cost if you travel often and spend a lot on your card.

Looking at specific cards can help understand the tradeoffs. The Chase Sapphire Preferred® Card for example, offers points on travel and dining and includes travel insurance and no foreign transaction fees, making it a good choice for travelers.

The Capital One Venture X Rewards Credit Card also offers robust travel rewards and perks, including access to premium lounges at airports. Both cards have an annual fee, but they offer enough rewards and benefits to make that fee worthwhile for frequent travelers or big spenders.

Cards For Bad Credit

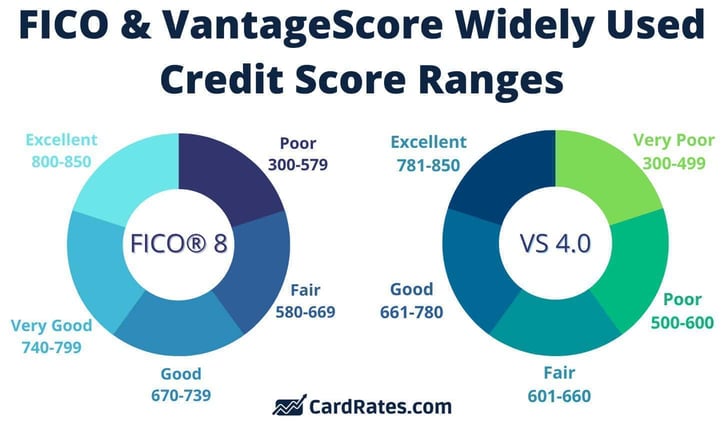

Subprime cards cater to consumers with bad or no credit history. They are available even if you’ve had trouble with credit in the past or are just starting to use credit. They typically aim for consumers with a FICO score below 580.

When you use them responsibly, these cards show that you can borrow money and pay it back on time. Using these cards wisely can improve your credit score over time. Doing so helps you obtain better loans and credit card offers in the future.

Subprime cards often charge annual fees. Issuers consider it risky to lend to people with bad credit, and they may not get their money back if a cardowner fails to pay their bill.

Annual and other fees (e.g., signup, monthly maintenance, foreign transaction) and high annual percentage rates of interest (APRs) help the issuing bank cover this risk. It’s a way for the banks to ensure they get some money, even if the cardholder has financial troubles.

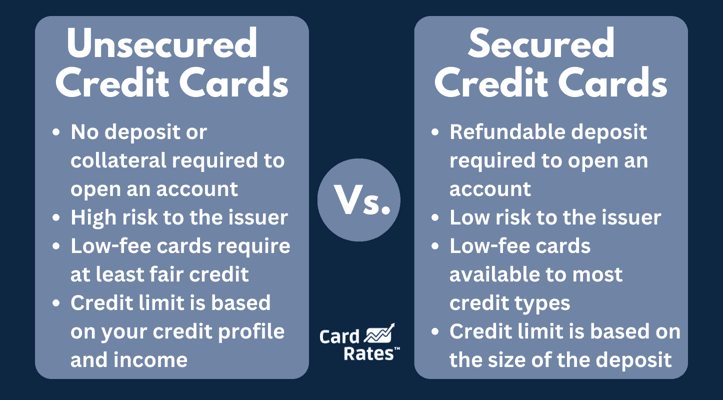

There are two main types of subprime cards: unsecured and secured. Unsecured cards do not require a deposit. However, they usually have higher annual fees and interest rates because the issuer takes a bigger risk. Issuers of these cards perform hard credit checks on applicants.

Secured credit cards, on the other hand, require a deposit that acts as collatoral. This deposit usually equals the credit limit. Because of this refundable deposit, the annual fees for secured cards are often low or waived. This makes secured cards a cheaper option if you’re trying to establish or rebuild credit, as long as you can afford the upfront deposit.

Several secured cards do not require hard credit checks when you apply, making them ideal for newbies with little credit history.

Business Credit Cards

Business credit cards are for business use, not for personal spending. They help business owners manage company expenses, track spending, and get rewards on their purchases.

You can use these cards to buy supplies, pay for travel, or cover other business costs. Having a business credit card also helps keep personal and business finances separate. That is essential for accounting and tax reasons.

Many business credit cards come with annual fees, especially those that offer more rewards and benefits. For example, the The Business Platinum Card® and the Ink Business Preferred® Credit Card charge yearly fees.

In return, they provide perks such as bonus points on business-related purchases, travel benefits, and tools for managing business expenses.

Business credit cards with annual fees often offer significant advantages that can be valuable to a business. These include higher reward rates on business spending, free employee cards, expense management tools, and advanced security features.

These cards add services that can help a business save money and operate more efficiently. The benefits of a business card can far outweigh the cost of your company’s spending on travel or office supplies.

Several very good business cards are available without annual fees, including the Ink Business Unlimited® Credit Card, the Capital One Spark Cash Select for Good Credit, and the Blue Business Cash™ Card. These $0-yearly fee cards are well worth considering because they offer rewards, bonuses, and other valuable perks.

Calculating the Cost-to-Benefit Ratio

When you have a credit card with an annual fee, it’s important to figure out if it’s worth owning. You want to make sure that the benefits you get from the card are worth more than what you pay. By calculating the cost-to-benefit ratio, you can decide whether keeping the card makes sense financially.

How to Determine Your Break-Even Point

To find out if you are breaking even with your annual fee, you need to look at how much you’re getting back from the card compared to what you’re paying. Here’s how:

- List the Benefits: Write down all the benefits your card offers. This may include rewards points, cash back, travel credits, or any other perks.

- Assign a Value to Each Benefit: Estimate the dollar value of each benefit. For example, if you get a $100 travel credit each year, that’s worth $100.

- Add Up the Benefits: Total the value of all the benefits you expect to use.

- Compare the Total to the Annual Fee: Look at the total value of the benefits and compare it to the card’s annual fee. If the benefits outweigh the costs, you are breaking even or doing better. If the benefits are less, you may lose money on the card.

Calculating this break-even point can help you make a smart decision about whether to keep the card or find one that better suits your needs.

Assess the Card’s Other Perks

Rewards are important, but cards with annual fees also provide other perks. Let’s work through an example.

Mary’s Story with the Chase Sapphire Preferred® Card

Mary decided to get the Chase Sapphire Preferred® Card, which has an annual fee of $95. She wanted to make sure she got her money’s worth from this travel card. Here’s how she did it.

Travel Points

Mary earns 2 points for every $1 spent on travel and dining. She spends about $500 a month on these categories, which is $6,000 in a year, earning her 12,000 points. Since points are worth about 1.25 cents each when used for travel through Chase’s portal, her points from dining and travel are worth $150.

Grocery Points

For the first year, she also earns extra points on groceries — 3 points per $1 spent. Spending $300 a month on groceries totals $3,600 a year, earning her 10,800 points. These points are worth $135 when used for travel.

Travel Credit

Mary uses the $50 annual hotel credit. She booked a hotel through the Chase portal and got $50 off her stay.

Travel Perks

The card includes trip cancellation and baggage delay insurance and no foreign transaction fees. Mary saves about $100 annually by not needing to buy separate travel insurance and another $50 by avoiding transaction fees on her trips abroad.

Adding it all up, Mary gets a total of $485 in benefits for the year, which far exceeds her $95 annual fee. By using her card wisely and taking advantage of all the perks, Mary easily gets her money’s worth from the Chase Sapphire Preferred® Card.

When to Opt for No-Annual-Fee Cards

Choosing a credit card without an annual fee may be a better option in several situations. Here are some scenarios where a no-fee card could be the best choice:

- Low Spending: Paying an annual fee may not make sense if you don’t spend a lot on your credit card. You probably won’t purchase enough to earn the rewards necessary to justify the fee.

- Simplicity: You may prefer keeping your finances simple without worrying about exploiting most of a card’s perks to justify a fee. No-annual-fee cards are straightforward and cost-effective.

- Building or Repairing Credit: A no-annual-fee card can be a good tool if you’re just starting out with credit or are repairing a poor credit score. It can help you build credit without the extra cost of a yearly fee.

- Secondary Card: A no-fee card may make more sense if you need a second card just for backup or certain types of purchases.

Here’s a short table summarizing the pros and cons of credit cards with no annual fees:

| PROS OF NO-FEE CARDS | CONS OF NO-FEE CARDS |

|---|---|

| No yearly cost | Fewer perks and benefits |

| Good for credit building | Lower reward rates |

| Simple to manage | Fewer luxury perks |

| Ideal for low-spenders | Might have higher interest rates |

Deciding between a card with an annual fee and one without depends on your spending habits, financial goals, and how much you value the extra perks that come with fee-based cards. A no-annual-fee card could be the right choice for you if the card’s perks don’t seem worth it or you prefer a simpler, more cost-effective option.

Research Annual Fees to Maximize Credit Card Value

When choosing a credit card, it’s important to consider whether an annual fee card is right for you. Annual fee cards often offer more rewards and perks, but they only make sense if you use enough of these benefits to make up for the cost.

To decide, consider your spending, the perks the card offers, and how these perks match your needs. Calculate the total value of all benefits and compare it to the annual fee to see if the card is worth it.

Also, consider a no-annual-fee card if you spend little on your credit card or if you prefer a simpler financial plan. Remember, the goal is to get a credit card that fits your spending habits and economic needs without costing you more than it’s worth.

![Global Entry vs. TSA PreCheck vs. CLEAR: Credit Card Benefit Comparison ([updated_month_year]) Global Entry vs. TSA PreCheck vs. CLEAR: Credit Card Benefit Comparison ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Global-Entry-vs.-TSA-PreCheck-vs.-Clear.jpg?width=158&height=120&fit=crop)

![7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year]) 7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/credit-cards-for-fair-credit-with-no-annual-fee-feat.jpg?width=158&height=120&fit=crop)

![7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year]) 7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_1092414950-1.jpg?width=158&height=120&fit=crop)

![5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year]) 5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Credit-Cards-For-Bad-Credit-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![3 Key Differences: Charge Card vs. Credit Card ([updated_month_year]) 3 Key Differences: Charge Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/charge-card-vs-credit-card.jpg?width=158&height=120&fit=crop)

![14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year]) 14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Rewards-Credit-Cards-with-No-Annual-Fee-Feat.jpg?width=158&height=120&fit=crop)

![7 Best No-Annual-Fee Credit Cards with Rewards ([updated_month_year]) 7 Best No-Annual-Fee Credit Cards with Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/No-Annual-Fee-Credit-Cards-with-Rewards.jpg?width=158&height=120&fit=crop)