Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

The prime rate is the best interest rate banks provide to their customers. Credit card companies often set their interest rates by adding extra percentage points to this prime rate.

If the prime rate goes up or down, so does the annual percentage rate (APR) on your credit card. When the prime rate goes up, borrowing money on your credit card gets more expensive. When it goes down, it gets cheaper.

-

Navigate This Article:

History of the Prime Rate

Tracking of the prime rate started in the 1940s as, basically, the best interest rate banks would give to their dependable big business customers. Over time, the rate was used more widely, affecting how much consumers pay on loans, including credit cards and mortgages.

The prime rate fluctuates according to the economy’s overall performance. Its effects ripple through the economy and help control borrowing costs. When things are going well and everyone is spending a lot, the rate usually goes up as more borrowers compete for loans.

An Example of Prime Rate Fluctuation Over 8 Years

| Effective Date | Rate | Effective Date | Rate |

|---|---|---|---|

| July 2023 | 8.50% | October 2019 | 4.75% |

| May 2023 | 8.25% | September 2019 | 5.00% |

| March 2023 | 8.00% | August 2019 | 5.25% |

| February 2023 | 7.75% | December 2018 | 5.50% |

| December 2022 | 7.50% | September 2018 | 5.25% |

| November 2022 | 7.00% | June 2018 | 5.00% |

| September 2022 | 6.25% | March 2018 | 4.75% |

| July 2022 | 5.50% | December 2017 | 4.50% |

| June 2022 | 4.75% | June 2017 | 4.25% |

| May 2022 | 4.00% | March 2017 | 4.00% |

| March 2022 | 3.50% | December 2016 | 3.64% |

| March 2020 | 3.25% | December 2016 | 3.50% |

However, when the economy is not doing well, and loan demand decreases, the rate goes down to make it cheaper for people to borrow money. Lower rates may also spur borrowing and spending to help the economy recover.

How the Prime Rate is Determined

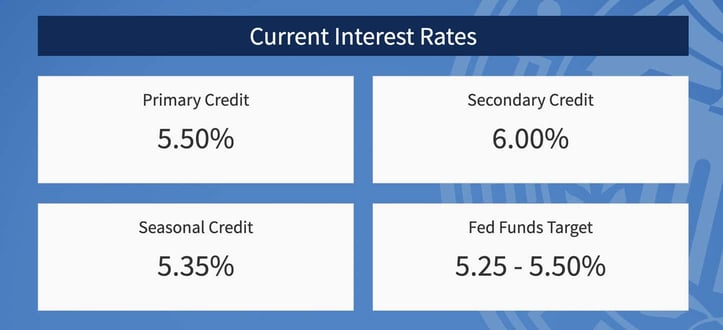

Banks set their prime rates by examining factors such as the federal funds rate (i.e., what banks charge each other for loans), the market’s performance, and signs of the economy’s condition. These factors help banks determine how much to charge their most creditworthy customers for loans.

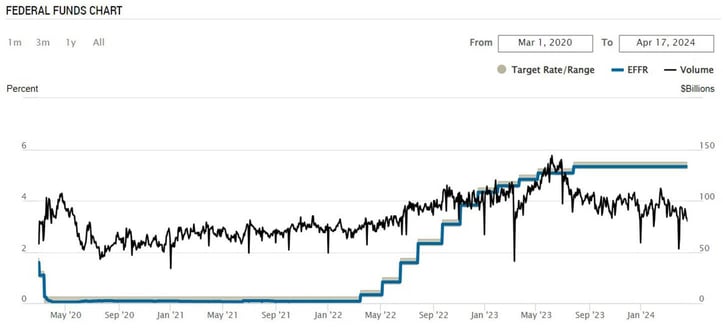

Federal Funds Rate

Since 1913, the Federal Reserve System (i.e., the Fed) has been the central bank of the United States. It controls how much money is available to the economy using several tools, including control of the federal funds rate. It aims to keep prices stable, maximize employment, regulate banking, and maintain moderate long-term interest rates.

A committee within the Fed sets the federal funds rate, which is the interest rate at which banks lend balances at the Federal Reserve to each other overnight. This rate influences other interest rates, including the prime rate.

The Fed may change the federal funds rate to control conditions such as inflation (when prices go up) and unemployment. If the economy is too hot, prices may rise too quickly. The Fed may increase the federal funds rate to make borrowing more expensive, which can slow down spending and cool the economy.

On the other hand, a slow economy may need a boost. The Fed may lower the federal funds rate to make borrowing cheaper. Accordingly, people and businesses can afford to spend more.

These Fed decisions directly affect the prime rate. Banks invariably increase the prime rate when the Fed raises the federal funds rate, making loans more expensive for people and businesses.

Conversely, suppose the Fed lowers the federal funds rate. In that case, the prime rate usually goes down (slowly), making loans cheaper and encouraging borrowing and spending.

Market Conditions

This term refers to what’s happening in the economy, such as businesses doing well or people spending a lot of money. When the economy is strong, and everyone is spending freely, banks may raise the prime rate as the demand for borrowing increases. This slows things down a bit and prevents prices from going too high.

But suppose the economy is weak and people need to spend more. In that case, banks may lower the prime rate to make loans cheaper, encouraging people to borrow and spend more. Generally, the state of the economy affects the prime rate’s current value and trend.

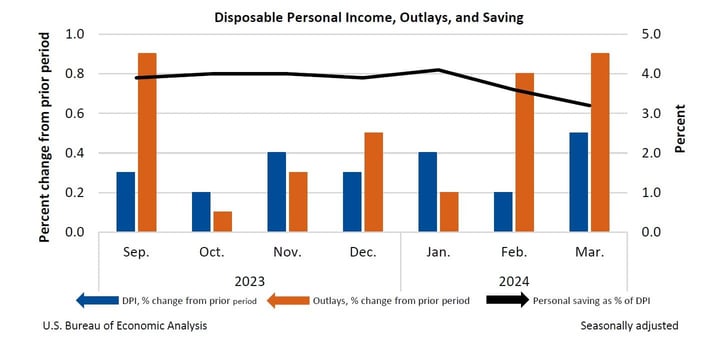

Economic Indicators

Economic indicators tell us whether the economy is doing well or not. The inflation rate is one of these clues, and it tells us how quickly prices are rising. When prices rise fast, goods and services rapidly become more expensive.

Banks monitor price growth and may increase the prime rate if prices rise quickly. Borrowing money will cost more, so people may spend less. Banks can raise rates as a way to earn higher interest income.

However, banks slowly reduce the prime rate if things become cheaper and fewer people have jobs. Competition among banks and other lenders tends to force interest rates lower. When it’s cheaper to borrow money, more people and businesses may take out loans and increase spending, which can help the economy get moving again.

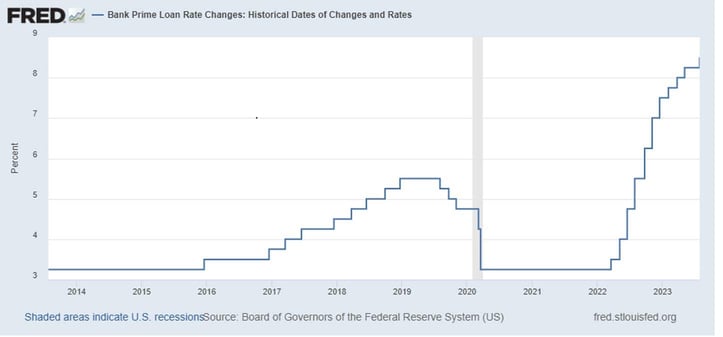

Historical Rate Changes

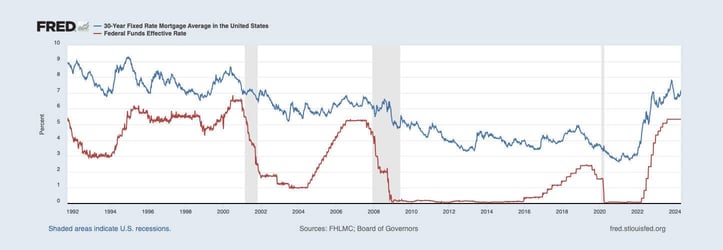

Sometimes, the prime rate remains relatively constant for long periods. At other times, it can trend up or down quickly. The graph below shows the history of US prime rate changes over an eventful recent decade:

Here’s a summary:

- From 2014 until the end of 2015, the prime rate was fairly stable, hovering around 3.25%.

- Starting at the end of 2015, the prime rate began to climb gradually. This was a period of economic growth when the Federal Reserve began to raise the fed funds rate.

- This upward trend continued until 2019. The prime rate peaked at around 5.5%.

- The prime rate sharply dropped in 2020 when the COVID-19 pandemic hit, causing economic uncertainty. As indicated by the shaded area, it quickly fell to around 3.25%, which encouraged borrowing and stimulated the economy during the recession.

- Following the initial shock of the pandemic, from late 2020 into 2022, the rate remained stable at this lower level.

- We see a steep increase in the prime rate starting in 2022 and continuing into 2023. This series of rate hikes was in response to changing economic conditions, such as a rebound in economic activity and rising inflation.

The graph’s shaded area indicates a time of economic recession, and you can see the prime rate goes down in response to economic downturns. Banks use these adjustments in the prime rate to help manage economic growth and inflation.

As is evident from the graph, the prime rate has seen wide swings following a few years of low inflation and a global pandemic.

How the Prime Rate Impacts Financial Products

The prime rate affects how much interest you pay on loans and credit cards. When the prime rate goes up, you usually pay more interest. When it goes down, you pay less.

Credit Cards

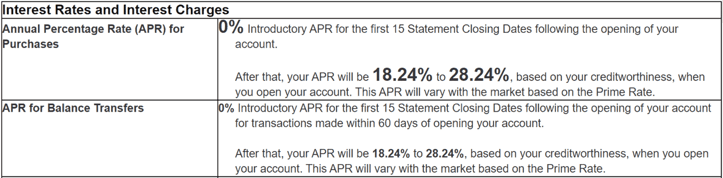

Credit card companies often tie the interest rate they charge, known as the Annual Percentage Rate (APR), to the prime rate. They’ll take the prime rate and add a certain number of percentage points to it to get your APR. For example, if the prime rate is 3% and they add 19 percentage points, your APR will be 22%. This means you’ll pay more in interest if you carry a balance on your credit card.

If the prime rate goes down, the process works the same way but in reverse. Issuers may lower your APR and the interest you pay. However, the pace of reducing card rates is usually slower than raising them.

Credit card agreements explain how the prime rate affects your APR. They state that your APR is the prime rate plus a certain amount, and issuers also inform you which prime rate they use (e.g., the one published in The Wall Street Journal).

Loans and Mortgages

As is the case with credit cards, the prime rate impacts the interest rates on other types of loans and mortgages, but it works a little differently for each.

For personal loans, especially those that are unsecured (meaning you don’t put up collateral like a house or a car), the interest rate you get is sensitive to the prime rate. Banks start with the prime rate and add a certain number of percentage points, depending on how risky they think it is to lend you money.

If the prime rate goes up, new loans become more expensive because banks increase their rates. However, existing personal loans typically carry a fixed rate, so your payments should remain the same even if new loans become more costly.

The interest rate on fixed-rate mortgages stays the same for the entire term of the loan, often 15 or 30 years. The prime rate influences fixed-rate mortgages only when the lender issues the loan. Your rate doesn’t change after that, even if the prime rate goes up or down.

APRs on adjustable-rate mortgages (ARMs) change over time. Initially, lenders often set rates lower than the rates on fixed mortgages, and the ARM usually remains fixed for a certain number of years (e.g., five, seven, or 10 years).

After that initial period, the rate adjusts at regular intervals, such as once per year. The adjustments depend on a benchmark interest rate (i.e., the secured overnight financing rate, or SOFR), to which lenders add a margin. While ARMs don’t directly follow the prime rate, they respond to the same economic factors that affect the prime rate.

When the prime rate changes, the benchmark rates lenders use to adjust ARMs often change, too. This means the interest rate and your payments on an ARM can go up or down during the life of the loan. For a fixed-rate mortgage, you don’t have to worry about rate changes once you close on the loan.

Auto Loans

Car loans and leases are similar to credit cards and some home loans because the interest you pay varies with the prime rate. But for car loans, the prime rate isn’t the only factor that affects your interest rate. Your credit score and the economy’s health also play a big role.

When the prime rate is low, you can get a better deal on a car loan. You will also pay less each month during the life of the loan. Sometimes, you can even find auto loans that don’t charge interest for a certain period.

Two Years of 60-Month New Car Loan Rate Fluctuation

| Date | Interest Rate | Date | Interest Rate |

|---|---|---|---|

| April 2024 | 7.82% | February 2023 | 6.27% |

| March 2024 | 7.82% | January 2023 | 6.18% |

| February 2024 | 7.91% | December 2022 | 6.13% |

| January 2024 | 7.75% | November 2022 | 6.05% |

| November 2023 | 7.70% | October 2022 | 5.63% |

| October 2023 | 7.66% | September 2022 | 5.16% |

| September 2023 | 7.51% | August 2022 | 4.99% |

| August 2023 | 7.40% | July 2022 | 4.84% |

| July 2023 | 7.18% | June 2022 | 4.82% |

| June 2023 | 7.14% | May 2022 | 4.61% |

| May 2023 | 6.87% | April 2022 | 4.47% |

| April 2023 | 6.58% | March 2022 | 4.12% |

| March 2023 | 6.46% | February 2022 | 3.99% |

When the prime rate goes up, borrowing money for a car gets more expensive. You’ll pay more each month and in total for the loan or lease.

Most car loans and leases have fixed interest rates, and your rate won’t change even if the prime rate does. If you grab a low rate when the prime rate is down, you won’t end up paying more later, even if the prime rate increases. However, if you’re looking to get a new car and the prime rate has gone up, you may have to deal with higher interest rates than before.

The Prime Rate and the Economy

The prime rate is like a temperature gauge for the economy’s health and can tell us if it’s too hot, too cold, or just right. Let’s take a deeper dive:

Economic Expansion

When the economy is growing and things are looking good (i.e., it is adding more jobs and businesses are doing well), consumers and businesses often spend a lot of money and may need to borrow funds. If the economy gets too hot, prices of products and services may start to climb too quickly (this is called inflation).

To cool it down, the Fed may raise the fed funds rate, causing the prime rate to go up. Higher rates make it more expensive to borrow money. This can slow down spending and borrowing and help keep inflation in check. A recession can occur if rates go too high.

If the economy starts to slow down too much, people may stop spending, and business growth may reverse. To warm things up, lenders may reduce interest rates, making it cheaper to borrow.

This encourages businesses to invest and people to spend money, which can help the economy get moving again.

Investment Decisions

Investors watch the prime rate because it affects many of their choices. If the prime rate is low, they often borrow money (e.g., through margin loans) to invest in stocks because they think these investments will grow more than the cost of the loan.

But if the prime rate is high, borrowing is more expensive, and savvy investors will be more careful, often choosing safer investments such as bonds.

The prime rate doesn’t just affect the margin of interest you pay on an investment loan; it’s a signal of how the economy is doing and influences how people and businesses decide to spend or invest their money.

How the Prime Rate Compares to Other Rates

The prime rate is a key interest rate that banks use, but there are other important rates, too. Each rate plays, or has played, a different financial role in the global economy.

LIBOR

LIBOR, or the London Interbank Offered Rate, was a rate that banks charged each other for short-term loans in the international market.

Lenders used it worldwide to set rates on mortgages and student loans.

Compared to the prime rate, which is usually for the best customers within the U.S. and often for longer-term loans. LIBOR was more about the rate at which banks lent to each other across borders and often for shorter periods.

Banks are phasing out LIBOR and replacing it with other rates because of some technical and legal problems. In the United States, the secured overnight financing rate, or SOFR, is replacing LIBOR. Unlike LIBOR, SOFR represents the cost of borrowing for a broader spectrum of market participants and depends on actual overnight lending transactions.

Federal Funds Rate

As discussed earlier, the federal funds rate is what banks charge each other for overnight loans in the United States. This rate is crucial because the Federal Reserve controls it directly to influence the economy.

The prime rate often moves with the federal funds rate, but it’s higher because it includes a bit extra for the bank’s own risk and profit. The Fed sends a signal to the economy when it changes the federal funds rate, and the prime rate usually follows in the same direction.

The Discount Rate

The discount rate is what banks pay to borrow money quickly from the Federal Reserve.

It’s higher than the federal funds rate, which is the rate banks charge each other because the Fed prefers banks to lend money to each other rather than requesting funds from the Fed.

The prime rate is typically higher than the discount rate. The discount rate is a special rate for banks that need emergency overnight funds. Its higher rate can make banks think twice about how much they lend since it’s costly for them to obtain emergency money from the Fed.

These different rates all play roles in how money moves around in the economy. They affect everything from the cost of loans for people and businesses to the overall health of the global economy.

Using the Prime Rate to Your Advantage

The prime rate can be a handy tool if you know how to interpret it correctly. It may even help you make better choices with your money, whether for your personal or small business finances.

Financial Planning and Decisions

It pays for both individuals and companies to watch the prime rate. The current rate can help you decide when to borrow money or make big purchases.

If the prime rate is low, it’s a good time to think about getting a loan or financing a big-ticket item because it’ll cost less in interest.

A high prime rate makes loans more expensive, so individuals and businesses think harder before borrowing money. This may also make both parties more careful with their spending and investment decisions.

Investment Strategies

Prime rate changes affect how people decide to invest or save their money. If the prime rate goes up, borrowing money becomes more expensive. Some investors may think twice before using lenders in their investment strategies. They might also move money to safer investment categories, such as bonds, because they can get better returns with higher interest rates without taking big risks.

On the other hand, when the prime rate goes down and borrowing money becomes cheaper, investors may decide to borrow funds to invest in stocks or real estate, hoping for a higher profit margin. They may also take some money out of bonds and put it into these investments because they think they can earn more money.

In short, investors monitor the prime rate and other indicators to help decide where to put their money for the best returns.

Credit Management

It’s also smart to pay attention to the prime rate to help you manage your credit and loans. If the prime rate goes up, new and variable-rate loans become more expensive. Pay down debt (such as student loans) or lock in a fixed interest rate if you can.

It may be a good opportunity to refinance existing loans if the prime rate is low. This can save you money on your monthly payments and overall costs.

The Prime Rate is a Pivotal Component of the Financial Landscape

The prime rate is important because it affects loan costs and reflects the economy’s performance. Knowing about the prime rate can help you make better choices for both personal and business finances.

Watching the prime rate enables you to decide when to borrow money or make big financial decisions, which may save you plenty of money in the long run.

![How to Calculate Credit Card Interest: 3 Steps to Find Your Rate ([updated_month_year]) How to Calculate Credit Card Interest: 3 Steps to Find Your Rate ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/how-to-calculate-credit-card-interest.jpg?width=158&height=120&fit=crop)

![APR vs. Interest Rate: Is There a Difference? ([updated_month_year]) APR vs. Interest Rate: Is There a Difference? ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/APR-vs-Interest-Rate-Feat.jpg?width=158&height=120&fit=crop)

![3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year]) 3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/lowerinterest.png?width=158&height=120&fit=crop)

![9 Best Flat Rate Cash Back Credit Cards ([updated_month_year]) 9 Best Flat Rate Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Best-Flat-Rate-Cash-Back-Credit-Cards.jpg?width=158&height=120&fit=crop)