Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Banks and credit unions that haven’t considered entering the point-of-sale financing space may be missing lending opportunities. FinMkt brings lenders, merchants, and borrowers together in one ecosystem. Its innovative financing solutions can help banks and credit unions extend their footprint to borrowers nationwide. FinMkt can fully onboard new partners in as little as three months.

Anyone who’s searched for a loan to finance a significant expense, such as the cost of building an addition to a home or undergoing an elective medical procedure, knows the process can be convoluted and time-consuming.

On the other side of the equation, lenders may struggle to attract borrowers qualified to receive loans for big-ticket purchases. And the merchants who offer the product or service that borrowers intend to purchase are another party in the process.

FinMkt is a technology company that provides software-as-a-service solutions. The company, which started in the peer-to-peer lending space, enables loan providers and merchants to seamlessly cater to consumers by providing them with nearly real-time financing options. We spoke with Jolynn Swafford, FinMkt’s Vice President of Growth and Partnerships, to learn more about how the company is revolutionizing digital lending.

Swafford said the consumer financing market has changed in recent years. In the past, consumers who needed money to pay for a significant expense would visit their bank or credit union and apply for a loan. Once the financial institution approved the loan, the consumer could use the funds to pay for their significant expense.

FinMkt examined the steps consumers undertook to secure a loan and, determining the operation was inefficient, sought to disrupt the process.

“We didn’t understand why it needed to take three to five business days, or longer, for someone to get a loan to fund a purchase,” Swafford said. “That doesn’t serve the customer or the business they’re working with.”

FinMkt’s desire to solve inefficient loan processes led the company to focus on programs allowing consumers to buy now and pay later.

“When we say ‘buy now, pay later,’ we mean a lot later,” Swafford explained. “With our service, consumers don’t have to repay their loans within six to eight weeks. We can link consumers with loans with terms up to 15 years for home improvement projects.”

Lending Services Designed for Specific Merchants

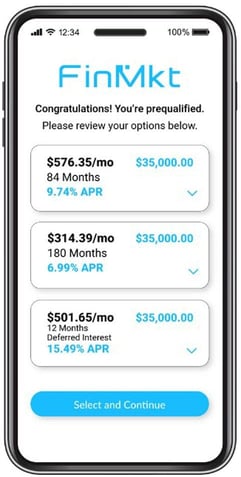

FinMkt offers a direct-to-consumer personal loan marketplace, Lendvious. Consumers using Lendvious enter information about the type of financing they seek, and Lendvious matches the consumer with different lending solutions. Swafford said Lendvious is similar to a matchmaking dating website but for personal loans.

FinMkt offers tailored solutions to serve niche markets, including the home improvement space and dental arena. Swafford said FinMkt’s services are in high demand by participants in these markets.

“Our lenders are really demanding more borrowers looking to fund home improvement projects and dental procedures,” Swafford said. “Lenders really like the way those loans perform. Dental implant technology has improved over the years, but implant procedures can be high-ticket items. Some dental implant cases can cost patients up to $50,000.”

FinMkt’s primary dental lenders offer borrowers up to five years to repay their loans. Swafford said dental offices that partner with FinMkt can sell their services to patients by promoting the minimum monthly payment a procedure requires as opposed to its total cost.

“Prior to services such as ours, dental offices had to offer in-house financing options to their patients,” Swafford said. “In that case, the dentists were the ones who were taking on all of the risk. Our dental financing solution is a win-win for both patients and dentists.”

Patients have a longer time to repay their loan through FinMkt’s dental financing solution than what a dentist could likely offer via in-house financing, Swafford said. And dentists who partner with FinMkt receive all their funds in advance, allowing them to focus on treating their patients without worrying about collecting payment for their services.

Helping Financial Institutions Extend Their Markets

FinMkt brings lenders, merchants, and borrowers together in one ecosystem, Swafford said. Large lenders approach FinMkt to reach consumers in need of a loan. FinMkt integrates lenders into its platform and connects them with customer-facing businesses, including contractors and dentists, who then connect the lender with consumers seeking financing products.

Swafford said FinMkt frequently works with credit unions to help them grow their business through participation in Fintech’s lending marketplace.

“Credit Unions are valued by their assets under management and how many members they have,” Swafford said. “Every time a credit union joins our platform, we connect them with dental customers all across the country. And every time a dental customer signs up for a loan through our service, they, in turn, become members of the credit union offering the loan.”

FinMkt provides underwriting services for banks and credit unions. It incorporates a partner financial institution’s credit policy, including stipulations for borrowers’ FICO scores, debt-to-income ratio, income, and geographic location, into its underwriting processes.

“If anything changes regarding a partner institution’s credit policy, then we can refine our practices to align with whatever direction the bank or credit union wants to go,” Swafford said.

Swafford said hosting a financial institution’s credit policy allows FinMkt to approve loans in as little as 90 seconds. FinMkt also captures the borrower’s signed loan documents.

The services FinMkt offers lenders include evaluating the merchants that financial institutions can connect with on FinMkt’s platform. Swafford said some financial institutions may only want to connect with merchants who have been in business for a specific number of years or have met certain revenue targets.

“We can minimize the risk for lenders by making sure they are being linked with merchants and contractors that possess the qualities they are looking for,” Swafford said

FinMkt Succeeds When Its Partners Win

FinMkt is a technology company driven by application programming interfaces (APIs). Swafford said the company’s extensive API documentation enables partners to connect their technology components to FinMkt’s platform and integrate quickly and accurately.

FinMkt can efficiently onboard new partners that have technology expertise. Swafford said tech-savvy partners can begin participating in FinMkt’s marketplace within three months of partnering within the company. Companies that are less technologically inclined can onboard within six to 12 months.

FinMkt assigns an implementation expert from its staff to work with a new partner’s product manager and shepherd them through the onboarding process.

FinMkt measures its success in light of the success of its partners. The company monitors the loan volume in its system to assess its performance. Swafford said increases in loan volume indicate that merchant partners are making money, consumers are accessing the funding they desire, and lenders are getting the business opportunities they seek.

“Loan volume is a really important indicator to us internally,” Swafford said. “It’s something that we measure on a daily basis.”

Banks and credit unions that partner with FinMkt don’t have to build a point-of-sale financing platform from scratch, which Swafford said can take financial institutions up to three years to complete.

“If you’re a lending institution and you haven’t already been thinking about how to get into the point of sale to make the lending process more streamlined for your customer, then you’re already behind,” Swafford said. “But there’s no need for banks and credit unions to do this on their own. We already have a point-of-sale solution built and ready for lending institutions. Members of Gen Z are demanding this service, so there is a sense of urgency.”

![9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year]) 9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/without2.png?width=158&height=120&fit=crop)

![What Is Netspend? The Company & Its Products ([updated_month_year]) What Is Netspend? The Company & Its Products ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/10/What-Is-Netspend.jpg?width=158&height=120&fit=crop)

![5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year]) 5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/loans2.jpg?width=158&height=120&fit=crop)