We deploy a step-by-step methodology to each piece of research we publish to ensure our studies offer complete coverage and meet our rigorous editorial standards.

The growing popularity of Buy Now, Pay Later (BNPL) services has revolutionized online shopping. BNPL allows consumers to split the cost of a purchase into smaller installments, typically interest-free, and pay it off over a set period.

While many appreciate the budgeting benefits and convenience, a sizable number also worry about the potential financial risks. We surveyed 1,000 American consumers to better understand how Americans are using BNPL services, current purchase and repayment trends, and their risks and regrets.

-

Navigate This Article:

Consumers Pay an Average of $123.61/Mo.

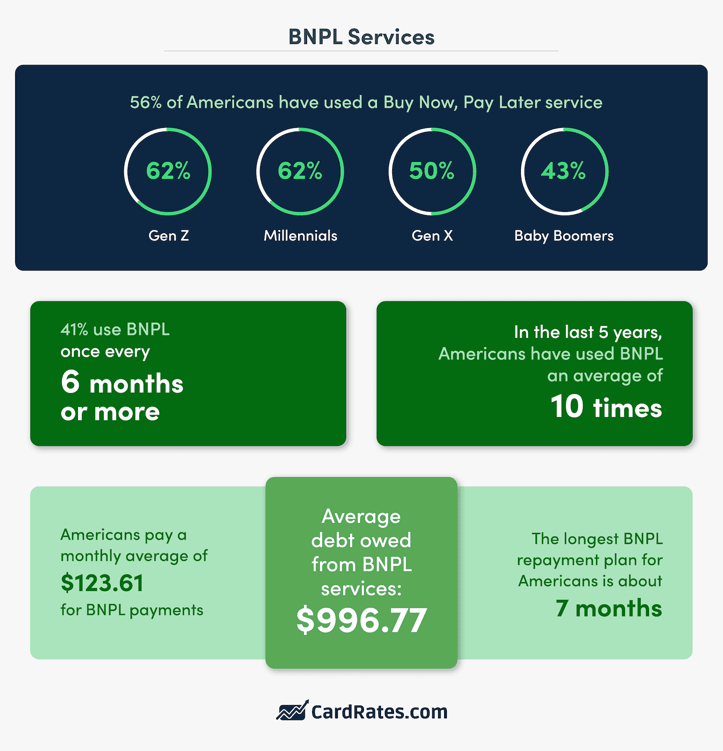

More than half (56%) of Americans surveyed have used a BNPL service. When broken down by generation, millennials and Gen Z are most likely to use these services. In the last five years, survey respondents have used BNPL an average of 10 times. But 41% said they have used it once or more every six months.

The amount Americans pay through a BNPL service varies, but on average, they pay $123.61 monthly for their BNPL purchases. The longest repayment plan is about 7 months. These monthly payments all go toward their overall BNPL service debt, which is an average of $996.77.

28% Currently Making a Payment to a BNPL Service

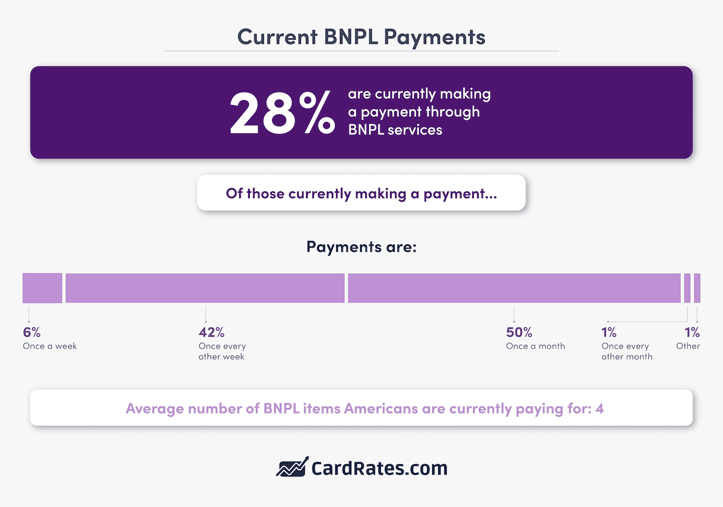

While the majority of Americans surveyed have used a BNPL service, 28% are currently making a payment. Payments are primarily either once every other week (42%) or once a month (50%). Some Americans are making repayments once a week (6%).

Of those currently financing through a BNPL service, they’re making payments on an average of four items.

Risks and Regrets of Using BNPL Services

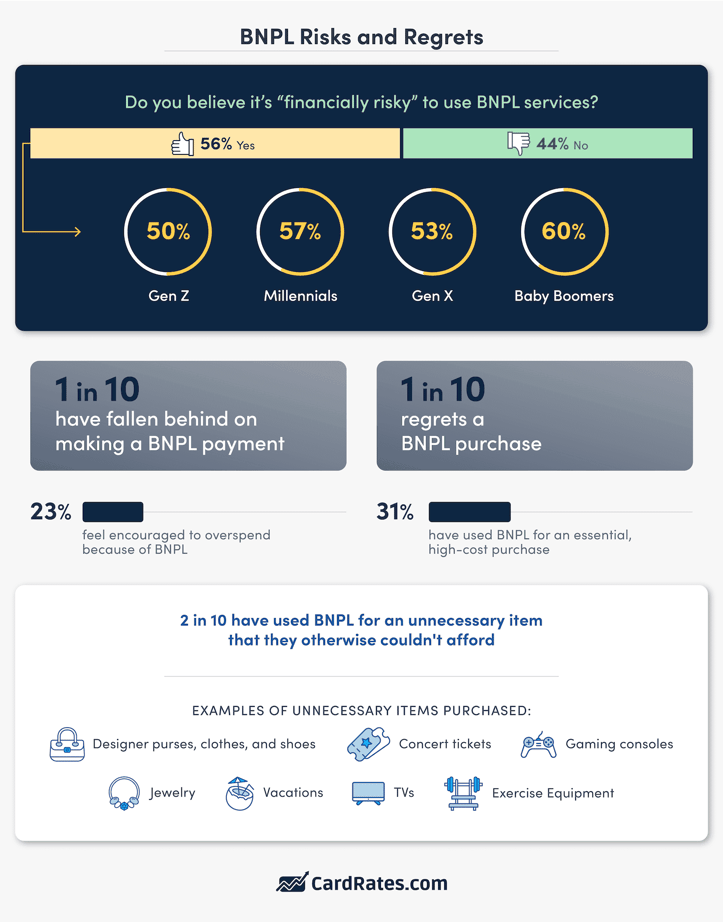

Despite using BNPL services, more than half of respondents (56%) believe BNPL is financially risky. The generations that believe in this risk most prominently include millennials (57%) and baby boomers (60%). One of these risks may be falling victim to the monthly repayments, and 1 in 10 admits to having fallen behind on one of these payments.

Nearly 1 in 4 feel encouraged to overspend because of the availability of BNPL, and 1 in 10 regrets something they’ve purchased through BNPL.

What types of items are Americans using BNPL for? More than 3 in 10 respondents have chosen to use BNPL for essential items, such as school supplies, and 1 in 5 have used BNPL for an unnecessary item they couldn’t otherwise afford. Examples of unnecessary items include designer purses, clothes or shoes, concert tickets, gaming consoles, vacations, jewelry, exercise equipment, and TVs.

BNPL Purchase Habits

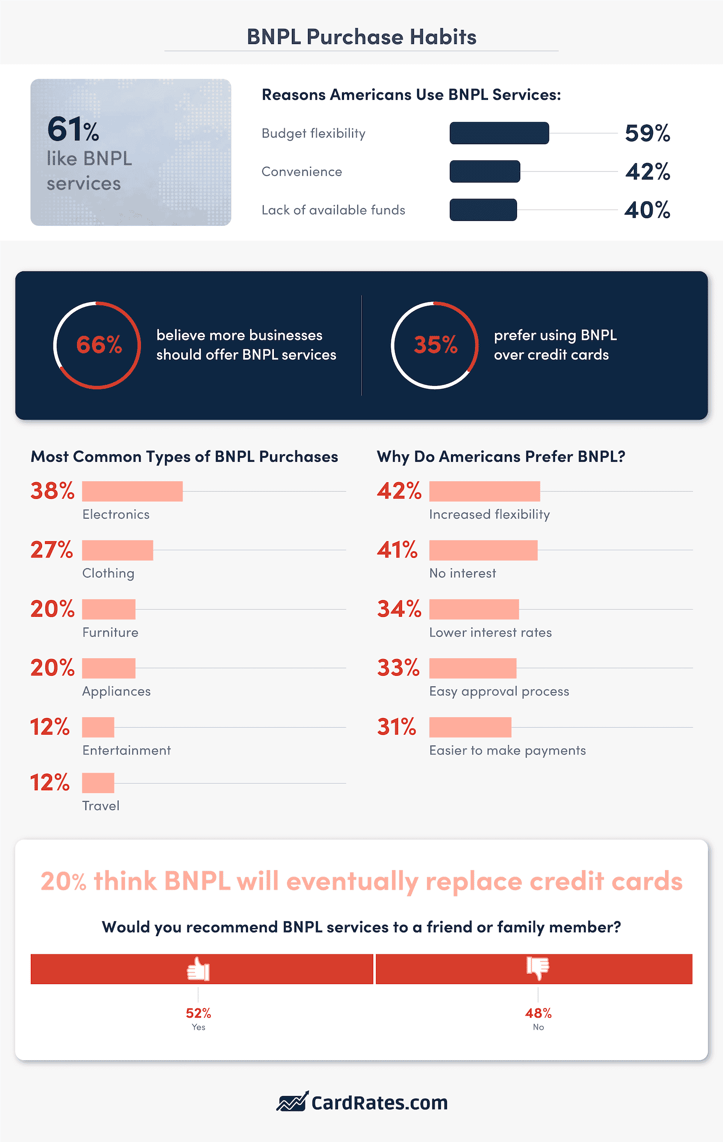

Even with the perceived risks and regrets, the majority (61%) of respondents like BNPL services, and 66% believe more businesses should offer them as a payment option. Americans use BNPL because of the budget flexibility it grants them (59%), the convenience (42%), and because of their lack of available funds (40%).

If Americans had to choose between using a credit card and using a BNPL service, 35% said they prefer BNPL. They appreciate its increased flexibility, no interest or lower interest rates, easy approval process, and that it’s easier to make payments. One in 5 even think BNPL will replace credit cards someday.

BNPL services offer consumers more flexibility, especially when funds may not be available, and more than half (52%) of those surveyed would recommend BNPL services to a family member or friend.

Methodology

In May 2024, we surveyed 1,000 Americans for their feedback on using Buy Now, Pay Later services. The age range of respondents was 18 to 80 with an average age of 42 years old. Respondents identified as 49% female, 50% male, and 1% non-binary.

![Credit Cards vs. BNPL Services: What to Know in [current_year] Credit Cards vs. BNPL Services: What to Know in [current_year]](https://www.cardrates.com/images/uploads/2024/02/Credit-Cards-vs.-BNPL-Services.jpg?width=158&height=120&fit=crop)

![5 Ways to Use Credit Card Rewards to Buy Airline Tickets ([updated_month_year]) 5 Ways to Use Credit Card Rewards to Buy Airline Tickets ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/How-to-Use-Credit-Card-Rewards-to-Buy-Airline-Tickets.jpg?width=158&height=120&fit=crop)

![How to Pay Bills With a Credit Card ([updated_month_year]) How to Pay Bills With a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/How-to-Pay-Bills-With-a-Credit-Card.jpg?width=158&height=120&fit=crop)